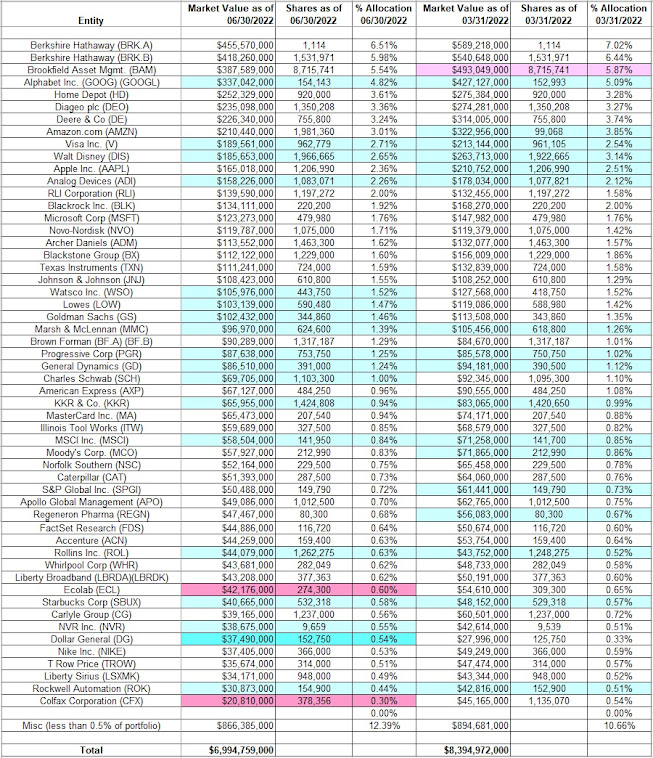

- Gayner’s portfolio decreased from $8.39B to $6.99B this quarter.

- Colfax and Ecolab were decreased while increasing Dollar General during the quarter.

- Berkshire Hathaway at ~13% of the portfolio is by far the largest position.

Thomas Gayner’s Markel Investment Portfolio value decreased from $8.39B to $6.99B this quarter. The portfolio continues to have around 100 different positions although only around 50 are significantly large (more than 0.5% of the portfolio each). The top-five stakes are Berkshire Hathaway, Brookfield Asset Management, Alphabet, Home Depot, and Diageo.

Markel Corporation (MKL) is currently trading at around

~1.28-times Book Value (BV) at ~$898 per share - BV is ~$1153.

Below is a spreadsheet that highlights the changes to the

portfolio as of Q2 2022. Please check out our previous

update to have an idea on how the portfolio is progressing:

To learn more about how to profit from a strategy of cloning

hedge fund picks, check out our book Profiting from Hedge Funds: Winning Strategies for the Little

Guy.

No comments :

Post a Comment