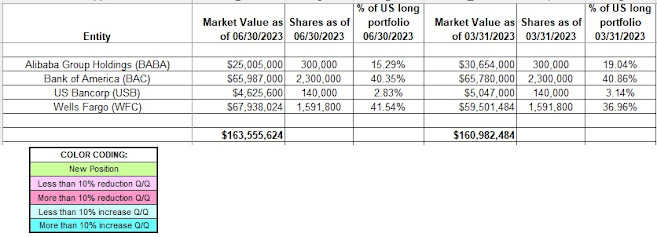

- Daily Journal (DJCO) Portfolio has just four positions.

- All positions were reduced significantly this quarter.

- The portfolio value decreased from $185M to $177M this quarter.

Daily Journal portfolio value decreased from $185M to $177M this quarter. Since their first 13F filing in Q4 2013, there have only been three changes to the holdings: POSCO was reduced significantly in Q4 2014 and dropped later on, and a large position was initiated in Alibaba Group Holdings in Q4 2020. After accounting for those changes, the portfolio has remained remarkably steady over the last ten years. To know more about Charlie Munger, check out the book Poor Charlie's Almanack: The Wit and Wisdom of Charles T. Munger.

Regarding the origins of this portfolio in 2009, Charlie Munger said the following during Daily Journal’s (DJCO) 2018 AGM Q&A: “In addition to Daily Journal's businesses, we have a great bundle of securities and want to dispel again that this is not some minor version of Berkshire. We have a bundle, because we bought them at a time when we preferred to own them to holding cash and had a lot of extra liquidity on hand that came to us by accident. The chances of more gains like what we have done in the last four or five years is zero. Oh, well we will have a big gain next quarter, because of a deferred tax reduction from the Trump tax code change, so we will look like a genius for one more quarter, I suppose.” The cost-basis of the positions acquired at the time was $63.4M.

The spreadsheet below shows Daily Journal’s 13F stock holdings as of Q1 2024. Please visit our previous updates to get an idea on how the portfolio has progressed: