- ValueAct’s 13F portfolio value increased from ~$4.37B to ~$4.39B this quarter.

- ValueAct added Amazon.com (AMZN) and increased Liberty Media (FWONK).

- The top three positions are Salesforce.com (CRM), Walt Disney (DIS), and Insight Enterprises (NSIT), and they add up to ~52% of the portfolio.

This article is part of a series that provides an ongoing

analysis of the changes made to ValueAct’s 13F stock portfolio on a quarterly

basis. It is based on their regulatory 13F Form filed on 2/14/2025. Please

visit our Tracking

ValueAct Portfolio article for an idea on their investment philosophy and

our previous

update for the fund’s moves during Q3 2024.

This quarter, ValueAct’s 13F portfolio value increased from

~$4.37B to ~$4.39B. The number of holdings increased from 10 to 11. The top

three positions are at ~52% while the top five are at ~74% of the 13F assets.

The largest position is Salesforce.com which is at ~22% of the portfolio. To

know more about ValueAct’s activist style of value investing, check out Deep Value: Why Activist Investors and Other Contrarians Battle

for Control of Losing Corporations.

Note: It was reported in April 2020 that ValueAct has built

a 2.6M share (~2% of the business, ~$1.1B) stake in Nintendo (NTDOY).

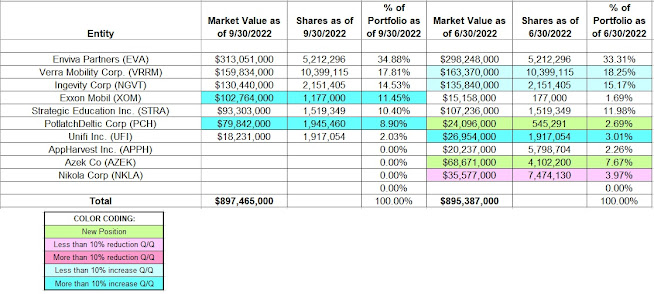

The spreadsheet below highlights changes to ValueAct’s 13F

stock holdings in Q4 2024:

Source: John Vincent. Data constructed from ValueAct’s 13F

filings for Q3 2024 and Q4 2024.