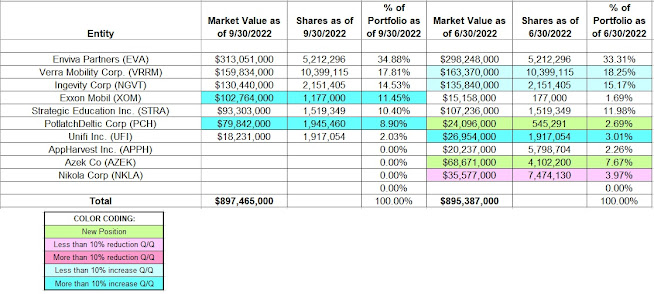

- Charlie Munger’s Daily Journal Portfolio has just five positions.

- The positions were untouched this quarter.

- The portfolio value decreased from $175M to $163M this quarter.

Charlie Munger’s Daily Journal portfolio value decreased

from $175M to $163M this quarter. Since their first 13F filing in Q4 2013,

there have only been two changes to the holdings: POSCO was reduced

significantly in Q4 2014, and a large position was initiated in Alibaba Group

Holdings in Q4 2020. After accounting for those two changes, the portfolio has

remained remarkably steady over the last nine years. To know more about Charlie

Munger, check out the book Poor Charlie's Almanack: The Wit and

Wisdom of Charles T. Munger.

Regarding the origins of this portfolio in 2009, Charlie

Munger said the following during Daily Journal’s (DJCO) 2018 AGM Q&A: “In

addition to Daily Journal's businesses, we have a great bundle of securities

and want to dispel again that this is not some minor version of Berkshire. We

have a bundle, because we bought them at a time when we preferred to own them

to holding cash and had a lot of extra liquidity on hand that came to us by

accident. The chances of more gains like what we have done in the last four or

five years is zero. Oh, well we will have a big gain next quarter, because of a

deferred tax reduction from the Trump tax code change, so we will look like a

genius for one more quarter, I suppose.” The cost-basis of the positions

acquired at the time was $63.4M.

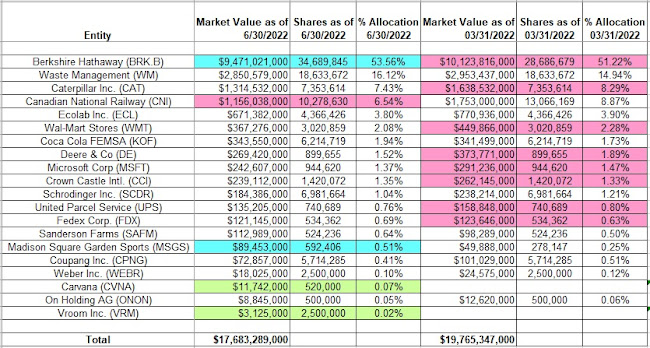

The spreadsheet below shows Charlie Munger's Daily Journal 13F

stock holdings as of Q3 2022. Please visit our previous updates to get an

idea on how the portfolio has progressed:

To learn more about how to profit from a strategy of cloning

hedge fund picks, check out our book Profiting from Hedge Funds: Winning

Strategies for the Little Guy .