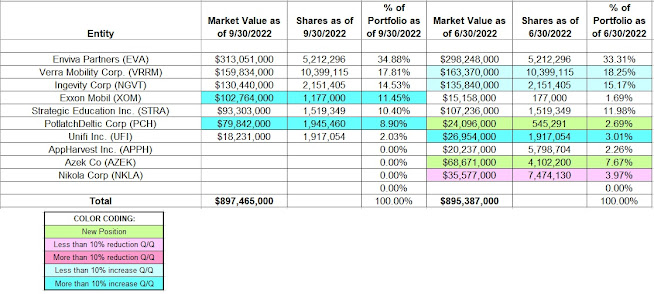

- Jeffrey Ubben’s 13F portfolio value increased marginally from $895M to $898M this quarter.

- They increased Exxon Mobil and PotlatchDeltic during the quarter.

- Enviva at ~35% of the portfolio is by far the largest position.

Jeffrey Ubben’s Inclusive Capital Partners 13F Portfolio

value increased marginally from ~$895M to ~$898M this quarter. The heavily

concentrated portfolio continues to have only a handful of positions.

Note: Regulatory filings show them owning significant

ownership stakes in the following businesses - ~10% of Unifi Inc. (UFI), 5.4%

of Ingevity Corp (NGVT), 5.7% of AppHarvest (APPH), 7.8% of Enviva Inc. (EVA),

and 6.7% of Vroom Inc. (VRM).

The spreadsheet below highlights changes to Inclusive

Capital Partners’ 13F holdings in Q3 2022. Please lookup our previous

update to see how the portfolio has progressed:

To learn more

about how to profit from a strategy of cloning hedge fund picks, check out our

book Profiting from

Hedge Funds: Winning Strategies for the Little Guy.

No comments :

Post a Comment