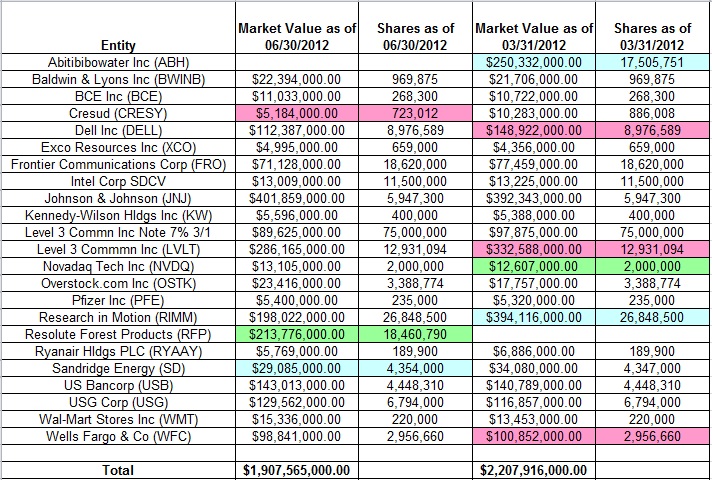

Below is a spreadsheet that shows the changes to Paulson's 13F US long portfolio as of Q2 2012. For a look at how his portfolio has progressed, see our Q1 2012 update:

Paulson's portfolio came down around 30% this quarter from around $14B to just over $11B - many of the fund's positions decreased in value and the fund also experienced large redemptions as the portfolio underperformed the indexes. Notable new positions include ~2% stakes in Equinix (EQIX) and JPMorgan Chase & Co. (JPM) and ~1% stakes in Cooper Industries PLC and Hillshire Brands (HSH). The largest two stake increases were SPDR Gold Trust ETF (GLD) and HCA Holdings (HCA).

Paulson's portfolio came down around 30% this quarter from around $14B to just over $11B - many of the fund's positions decreased in value and the fund also experienced large redemptions as the portfolio underperformed the indexes. Notable new positions include ~2% stakes in Equinix (EQIX) and JPMorgan Chase & Co. (JPM) and ~1% stakes in Cooper Industries PLC and Hillshire Brands (HSH). The largest two stake increases were SPDR Gold Trust ETF (GLD) and HCA Holdings (HCA).