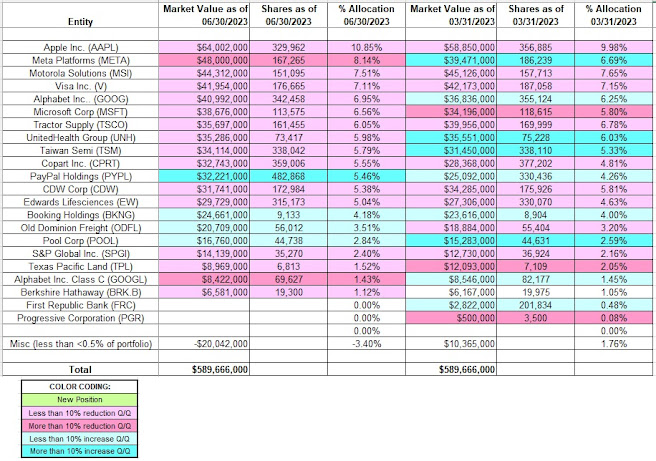

- Wedgewood Partners’ 13F portfolio value remained at ~$590M this quarter.

- They increased PayPal (PYPL) while reducing Meta Platforms (META) and Alphabet (GOOG).

- Their top five positions are at 40% of the overall portfolio.

This article is part of a series that provides an ongoing

analysis of the changes made to Wedgewood Partners’ 13F stock portfolio on a

quarterly basis. It is based on David Rolfe’s regulatory 13F

Form filed on 8/14/2023. The 13F portfolio value remained steady at $590M

this quarter. The holdings are concentrated with recent 13F reports showing

around 30 positions. There are 20 securities that are significantly large (more

than ~0.5% of the portfolio each) and they are the focus of this article. The

largest five stakes are Apple (AAPL), Meta Platforms (META), Motorola Solutions

(MSI), Visa (V), and Alphabet (GOOG). They add up to ~40% of the portfolio. Please

visit our Tracking

David Rolfe’s Wedgewood Partners Portfolio series to get an idea of their

investment philosophy and our last

update for the fund’s moves during Q1 2023. Wedgewood has generated

significant alpha since its 1992 inception. David Rolfe also sub-advises

Riverpark/Wedgewood Fund (RWGIX) (RWGFX) as portfolio manager, a mutual fund

incepted in 2010.

The spreadsheet below highlights changes to David Rolfe’s US

stock holdings in Q2 2023:

Source: John Vincent. Data constructed from Wedgewood

Partners’ 13F filings for Q1 2023 and Q2 2023.

No comments :

Post a Comment