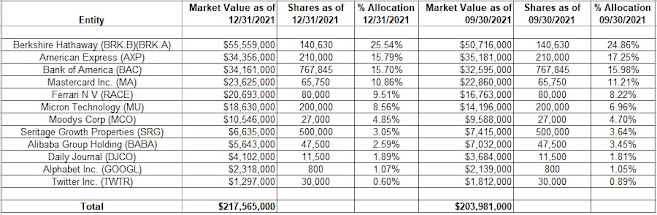

- Aquamarine Capital’s 13F portfolio value increased from $204M to $218M.

- The portfolio was untouched this quarter.

- Berkshire Hathaway, American Express, and Bank of America are the three largest positions.

Guy

Spier’s Aquamarine Capital Portfolio value decreased from $204M to $218M during

the quarter. The portfolio is very concentrated with just 12 positions. The

largest five positions are Berkshire Hathaway (BRK.A), American Express (AXP),

Bank of America (BAC), Mastercard Inc. (MA), and Ferrari NV (RACE). They

together add up to ~77% of the entire portfolio.

Below

is a spreadsheet that highlights the changes to the portfolio as of Q4 2021.

Please check out our previous update to have an idea on how the

portfolio is progressing:

To learn more about how to profit from a strategy of cloning

hedge fund picks, check out our book Profiting from Hedge Funds: Winning

Strategies for the Little Guy.

No comments :

Post a Comment