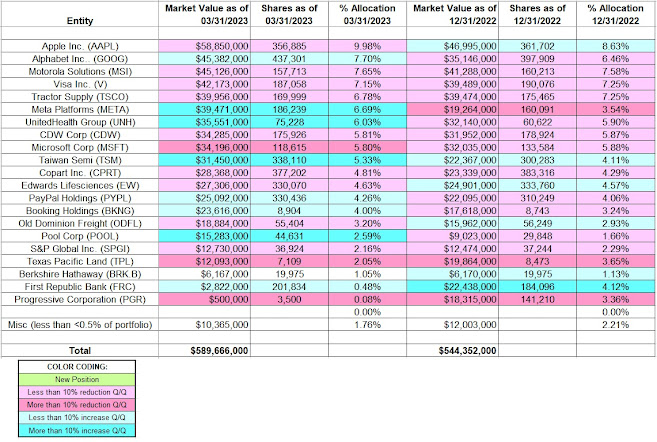

- Wedgewood Partners’ 13F portfolio value increased from $544M to $590M this quarter.

- They increased Meta Platforms while reducing Microsoft and Progressive Corporation.

- Their top five positions are at 39% of the overall portfolio.

This article is part of a series that provides an ongoing

analysis of the changes made to Wedgewood Partners’ 13F stock portfolio on a

quarterly basis. It is based on David Rolfe’s regulatory 13F

Form filed on 5/15/2023. The 13F portfolio value increased from $544M to

$590M this quarter. The holdings are concentrated with recent 13F reports

showing around 30 positions. There are 21 securities that are significantly

large (more than ~0.5% of the portfolio each) and they are the focus of this

article. The largest five stakes are Apple Inc., Alphabet, Motorola Solutions,

Visa, and Tractor Supply. They add up to ~39% of the portfolio. Please visit

our Tracking

David Rolfe’s Wedgewood Partners Portfolio series to get an idea of their

investment philosophy and our last

update for the fund’s moves during Q4 2022.

Wedgewood has generated significant alpha since its 1992

inception: 11.29% annualized returns over the 30-year period compared to 9.56%

annualized for the S&P 500 Index. David Rolfe also sub-advises Riverpark/Wedgewood

Fund (RWGIX) (RWGFX) as portfolio manager, a mutual fund incepted in 2010.

The spreadsheet below highlights changes to David Rolfe’s US

stock holdings in Q1 2023:

Source: John Vincent. Data constructed from Wedgewood

Partners’ 13F filings for Q4 2022 and Q1 2023.

No comments :

Post a Comment