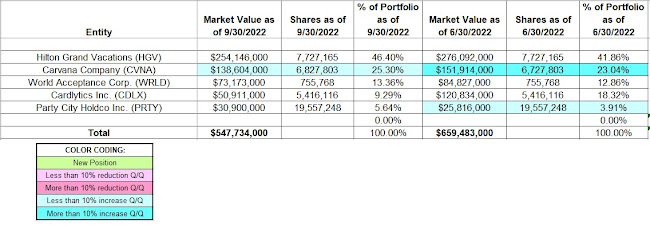

- Clifford Sossin’s 13F portfolio value decreased from $660M to $548M this quarter.

- The Carvana stake was increased during the quarter.

- Hilton Grand Vacations at ~46% of the portfolio is by far the largest position.

Clifford Sossin’s CAS Investment Partners 13F Portfolio

value decreased from ~$660M to $548M this quarter. The heavily concentrated

portfolio continues to have less than ten stakes.

Note: They have large ownership stakes in the following

businesses: ~17% of Party City (PRTY), ~12% of World Acceptance (WRLD), 6.4% of

Hilton Grand Vacations (HGV), and ~16% of Cardlytics (CDLX).

The spreadsheet below highlights changes to CAS Investment

Partners’ 13F holdings in Q3 2022. Please lookup our previous

update to see how the portfolio has progressed:

To learn more

about how to profit from a strategy of cloning hedge fund picks, check out our

book Profiting from

Hedge Funds: Winning Strategies for the Little Guy.

No comments :

Post a Comment